Research Article - (2022) Volume 12, Issue 2

The Impact of Adopting Professional Information Ethics on Business Performance in Jordanian Banks

Othman Abdulkader Obeidat1*, Nidal-Al-Ahmad2*, Mohammad Khaled Issa Al Shboul1* and Siham Ahmad3*Abstract

The study aims to demonstrate the impact of adopting professional information ethics on business performance in Jordanian banks. The researcher developed a questionnaire from previous studies; it included (45) items to collect data from the study sample. A regular stratified sample of employees in Jordanian banks was chosen with (350) employees distributed among managers, heads of departments and employees. The results indicated that there is a statistically significant impact of adopting professional information ethics on business performance in general and achieving profits and developing services, which in turn has a positive impact on preserving information as a resource, goal and product for Jordanian banks. The study recommended increased attention to information ethics and the training and development of employees on its importance and application in the performance of their daily work. As far as the researcher knows, this is the first study that indicates the extent of the commitment of employees in Jordanian banks to the ethics of information and the extent of its positive reflection on business performance, since other studies discussed the ethics of electronic business and its impact on the performance of money in banks.

Keywords

Professional Ethics, Information Ethics, Jordanian Banking, Performance, Business.

Introduction

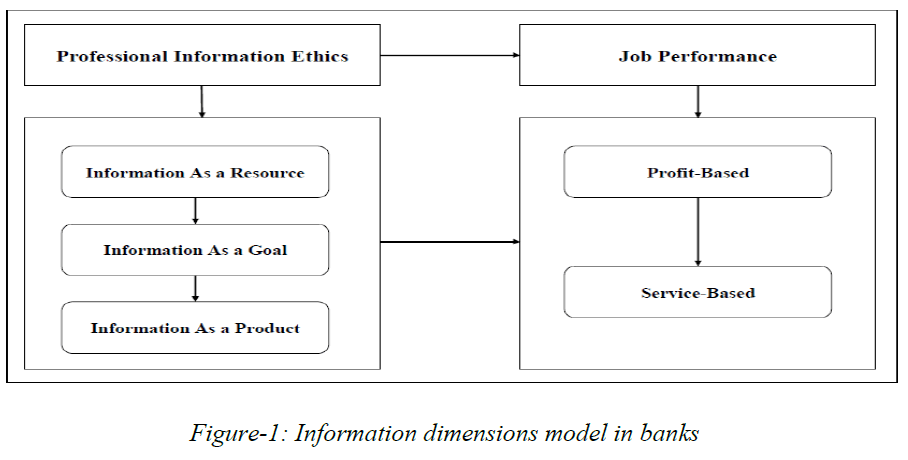

Technological and digital transformations in the business environment have become necessities in our lives with notable reliance on information ethics. Therefore, any technology that radically changes the information life cycle leads to profound ethical implications for any type of business, including banking. Thus, we are talking about an existential revolution, not just a change in information and communication technology. Likewise, information and communication technologies do not, by changing the context in which ethical issues emerge, fundamentally add new dimensions to old problems, but rather lead to a systematic rethinking of the same foundations on which our ethical positions at work are based. Respect and honesty are key components of business ethics. All employees are expected to represent the work environment ethically because they are a part of it. Therefore, information and communication technologies affect the moral life of the active worker in multiple ways. Information can be organized according to three tracks as "resource, goal, and product (Hindawi, 2020). For example, if an employee must mention a bank's policy to a customer, he might say "I'm sorry, but this is the bank's policy in this situation". Therefore, information ethics is another preferred type of standards in how business is carried out, and it is expected that everyone will represent it in the work environment.

Information ethics in business is one of the basics of success because it reflects the confidence of the work environment on the customers it serves, and the commitment to information ethics leads to the provision of high-quality services, in addition to the development and sustainability of work in light of information development (Al-Tarawneh, 2013) through honesty in personal transaction. For example, employees are expected to support professional information ethics by not engaging in any type of conflict of interest, performance, efficiency and effectiveness of information in the work environment to achieve the goals for which the institution was established, whether being profit or service, with the aim of providing fast and quality service and meet the needs of customers (Al- Qashi, 2003; Zwick, 2006).

Accordingly, any type of institution, including banks, should have rules and behaviors for professional information ethics that must be consistent with the laws (Al-Ali & Qasim, 2012). In general, professional information ethics in the internal and external work environment includes upholding honesty and respect in the profession over personal needs, conflicts or prejudices.

Literature Review

The study problem and questions

In the digital age, the risk ratio has increased dramatically, especially in banking systems. Some of them are related to privacy, information security, data theft, deletion or modification, whether by individuals working inside or outside the bank.

Hence the idea emerged for studying professional information ethics among the employees of Jordanian banks and the extent of their commitment to the ethical rules and behavior, whether towards their work environment or towards customers, and measuring the effect of this on work performance. Through this, the study attempts to answer the following questions:

1. To what extent is the application of ethics in professional information in Jordanian banks from the point of view of employees and management?

2. What is the level of evaluation of the dimensions of professional information ethics as (resource, goal, and product) of the bank on business performance from the viewpoint of employees and management in Jordanian banks?

3. Are there statistically significant differences at the level of significance (α ≤ 0.05) in the responses of bank employees in Jordan about the degree of commitment to professional information ethics from the employees' own viewpoint, due to the variable of gender, employee and manager?

Objectives of the study

The main objective of this study is to identify the impact of adopting professional information ethics on business performance in Jordanian banks from the point of view of employees and management in addition to the following goals:

• Identifying the effect of the degree of commitment to professional information ethics in Jordanian banks from the employees' point of view.

• Identifying the dimensions of professional information ethics as a resource, a product, and the goal that have impact on work performance in Jordanian banks.

Importance of the study

The importance of the study indicates stating the role of professional information ethics in business development and sustainability in the digital environment, and its ability to compete at the local, regional and global levels in addition to meeting the needs of customers to the fullest, with its importance in both respects:

•Scientific: By contributing to providing decision-makers in institutions in general and banks in particular, with the importance of professional information ethics in business development.

•The process: Applying the results of this study to the performance of business in banks through commitment to apply ethics of professional information in all aspects of profit and service.

Conventional and procedural definitions

•Etiquette and morals: The word "ethics" and "morals" are used synonymously, but neither is consistently used. Generally speaking, ethics refer to a high level of professional behavior, while morals are anchored on ethical standards. Ethics can refer to any generally accepted customs of behavior and the right to live in society.

•Information ethics: Ethical principles for knowledge societies emerged from the Universal Declaration of Human Rights and included the right to freedom of expression and universal use of information, especially the information involved in the public domain, the right to education, the right to privacy, and the right to participate in cultural life. The international debate on information ethics centers on the ethical, legal and social aspects of ICT applications (UNESCO, 2019).

•Work ethics: Business ethics are the principles, practices, and philosophies that guide business people in their daily business decisions. It concerns the business behavior of an entrepreneur in a business situation and is primarily concerned with the effects of the decision of society, with the business organization and outside it.

•Professional ethics: Professional ethics are standards or codes of conduct established by people in a particular profession. The Code of Ethics is a part of the expectations of those involved in many different types of professions. People in the profession do not want to Condone bad, dishonest, or responsible behavior if it is caused by someone in their field. By defining the expected behaviors in the form of a professional ethic, professionals work together to try to preserve a good reputation. Professional ethics is generally known as ethical business practices.

•Business performance: The outputs and goals that the organization seeks to achieve through its employees, and this concept also reflects the objectives of the institution and the means necessary to achieve them; therefore the concept links the practical activities, goals and duties that the workers undertake to achieve everything the institution seeks (Omodara, Ikhile, Ogundana, & Akin-Akinyosoye, 2020; Kuvas, 2006).

•Profitability: The remaining income after paying all costs, including labor costs, materials, interest on debt, taxes, and the ability to achieve economic value added to the commercial activities as a reward for business owners for investment, and is highlighted through revenues over expenditures (Amadeo, 2020).

•Service: The services sector produces intangible things, and more precisely services instead of goods, and according to the US Census Bureau, it includes various service industries including government services and commercial sector services such as banks, securities and other investment services; professional services, healthcare, arts, entertainment and recreation. Countries with economies centered on the service sector are more advanced than industrial or agricultural economics (Investopedia, 2020).

•Study model: The study model consists of two variables (independent and dependent) based on previous studies, as shown in the following Figure 1.

Figure-1: Information dimensions model in banks

Literature discussions

The literature on professional information ethics will be discussed in terms of being a resource, a goal and a product for banks with their reflection on business performance in terms of profitability and service.

Information ethics as a resource of service and profit

Information plays a major role in the professional ethics of employees of institutions in general and banks in particular, where the employee is expected to strive to continue to act according to the best information he has, and to make the best use of any information he can collect in order to achieve better results. The employee's moral responsibility is directly proportional to the degree of the available information. Any decrease in information is reflected on the decrease in moral responsibility and distinguishing between the correct and incorrect decisions (Hindawi, 2020). After 13 years of the financial crisis, public opinion is still losing confidence in the integrity of banks in terms of the ethics of the information they provide to people, especially in the Arab countries. They are always called "swindlers or fraudsters" (Rietdijk, 2021). Hence, the extent of honesty and integrity of the information provided by the employees in performing their duties, and working with transparency is controlled by placing the bank’s interests above theirs. There are also many ethical models that decision-makers and employees rely on in making decisions and the factors that affect the degree of commitment to ethics such as (Kohlberg's Model) For moral development (Jasevičienė, 2012).

Banking is one of the main and crucial sectors on which all other sectors of the economy depend. Reliable information is the basis the bank relies on while providing service and making profit, so the issue of ethics is more important in banking (Kour, 2017). Therefore, any work in life needs information, and ethics need information as it is a resource in the application of work in banks and the more information the better the work as a general rule to distinguish between acceptable and unacceptable behavior (Resnik, 2020). Many bad decisions are made as a result of bad information.

Whether it is the quantitative and qualitative presence or the complete absence of information as a resource, there is a very good reason why information ethics is described as the study of ethical issues arising from the availability, accessibility, and accuracy of information resources, regardless of their form, type, and support. Material to perform the work in an integrated manner.

Information ethics as a product of service and profit

The second role that information plays in professional ethics. It is the description of information as a "product" of the employee's ethical assessments and actions. The employee is not only considered a consumer of information, but also a producer of information, who may be subject to restrictions while taking advantage of opportunities. These limitations and opportunities require an ethical analysis.

Hence, it has been proven from time to time that employees who are satisfied with the environment in which they work are more productive than unhappy employees. Unethical practices in the workplace can cause widespread unrest with employees, leading to greater feelings of dissatisfaction with the work they do and with employers (Horton, 2020). Therefore, information ethics as we now understand it as a product in a business environment may cover ethical issues stemming from contexts such as: accountability, liability, defamation issues, theft, and misinformation (Hindawi, 2020). Therefore, ineffective management of information products may lead to tragic consequences.

When work ethics are encouraged by management and executives in a company for example, the ability of employees to focus on the work they need to complete the work increases dramatically. Productivity increases when there are fewer distractions and higher morale, and this leads to greater profit levels for the company (Horton, 2020). Also, at the present time, technology plays an important role in a business environment that requires taking into account the ethics of the professional information it produces, which must exceed the financial minimum. Martin and colleagues' study (2019) indicated that how might a particular technology fit into a broader understanding of a company's purpose, such as creating value for the company and its stakeholders? Neither the efficiencies resulting from the use of digital technology, nor the financial return for stock investors justifies the development, use or marketing of the technology, but they must agree with the arguments of business ethicists, and their discussions about the purpose and responsibilities of for-profit companies, including banks. Therefore, the fact that companies aim to profit using new technology raises the question of how the profit motive affects the ethics of new digital technology and the information it produces (Martin, Shilton, & Smith, 2019).

Information ethics as the goal of service and profit

Aside from employee inputs of information as resources, and outputs as products, there is a third axis of importance in business intelligence ethics, particularly when employee ethical evaluations and actions affect the informational business environment. Therefore, it is imperative for institutions, including banks, to provide codes and ethical rules to define, maintain and dispose of acceptable and unacceptable behavior standards. A good ethical framework can help guide actions during times of stress and heightened work pressure, and reduce susceptibility to misconduct (Conroy, 2021). Examples of professional information ethics include the employee's respecting or violating the privacy or confidentiality of another person's information. The examples also include piracy against profit-making institutions, including banks as represented by the unauthorized access to an information system that has become technology today. Therefore, ensuring ethical workplace practices, such as personnel policies, can avoid costly lawsuits or fines in the future. All of this can translate into great public relations in a business environment (Bourgeois, Smith, Wang, & Mortati, 2019).

The World Watch Institute indicated that the modern business landscape is characterized by an increasing number of companies aiming to create a positive social and environmental impact in addition to making profits. Customer care is the cornerstone of ethical business practices. Also, these endeavors could help them reduce costs, and thus increase their profits effectively (Washington State University, 2020).

Finally, reference can be made to John Stewart's "Freedom of Thought and Dialogue" (1806-1873), one of the classic books on information ethics that has been interpreted with information ethics as a goal. Juliet is shown by simulating her death and Hamlet by acting as preparation for the murder of his father; how unsafe management of the information environment may lead to material and moral consequences and losses.

Methodology

The study used the descriptive analysis method by distributing a questionnaire to collect and analyze data to answer the study questions, and the study population is represented by all employees at all their job levels, which amount to (350) and by choosing a regular stratified sample of employees and those who wish to actually answer the questionnaire. The data collected from the questionnaire were coded and entered into the Statistical Package for Social Sciences (SPSS).

Sample characteristics

Frequency and percent are used to describe the sample characteristics summarized in Table 1.

| Categories | Frequency | Percent |

|---|---|---|

| Male | 204 | 58.3 |

| Female | 146 | 41.7 |

| Total | 350 | 100 |

Table 1: Gender of Respondents

Above Table Shows that (58.3%) of the Sample are Females and the Rest are Males.

It is found that 64.6% of the Sample is Studying Bachelor Degree whereas 35.4% of the Sample is Studying Master Degree in Table 2.

| Categories | Frequency | Percent |

|---|---|---|

| BA | 226 | 64.6 |

| Master | 124 | 35.4 |

| Total | 350 | 100.0 |

Table 2: Level of Education

It is found that 50.3% of the Sample is working as Employees Followed by those who are working as Head of the Department (Table 3).

| Categories | Frequency | Percent |

|---|---|---|

| Employee | 176 | 50.3 |

| Head of the Department | 87 | 24.9 |

| Assistant Manager | 75 | 21.4 |

| Department Manager | 12 | 3.4 |

| Total | 350 | 100.0 |

Table 3: Type of Job

It is found that 33.7% of the Sample has Experience Between 1-5 years, 40% of the Sample has Experience Between 6-10 years and the Rest has Experience for More than 10 Years as shown in Table 4.

| Categories | Frequency | Percent |

|---|---|---|

| 1-5 | 118 | 33.7 |

| 6-10 | 140 | 40.0 |

| 11-15 | 12 | 3.4 |

| 16-20 | 13 | 3.7 |

| 21 or more | 67 | 19.1 |

| Total | 350 | 100.0 |

Table 4: Level of Experience

Reliability test

The (Cronbach Alpha) test was used to measure the consistency of the questionnaire; it was found that the values for the study variables are higher than the acceptable percentage (0.60), which is shown in Table 5.

| S. No | Variable | Alpha |

|---|---|---|

| 1 | The extent to which bank employees adhere to the ethics of professional information in the work environment to achieve service and profits | 0.871 |

| 2 | Assessing the dimensions of professional information ethics as a (resource, goal, and product) for the bank | 0.898 |

| All the Variables | 0.922 | |

Table 5: Cronbach's Alpha Transactions for the Study Areas

Above table Shows that the Questionnaire is Reliable Since alpha Value for Each Variable is Greater than 0.60.

Answering the study questions

1. What is the extent to which bank employees adhere to the ethics of professional information in the work environment to achieve service and profits?

Mean and standard deviation are used to answer the above question. The following scale was adopted to determine the level of acceptance for each variable shown in Table 6.

| Category | Level of acceptance |

|---|---|

| 1-2.333 | Low |

| 2.34-3.66 | Medium |

| 3.67-5 | High |

Table 6: Level of Acceptance for Each Variable

Above Table 7 shows that the grand mean of the variable reflects high level of acceptance toward above variable. Also, it was found that (The bank employee focuses on adhering to the ethics of professional information specified by the bank) has the highest acceptance level, whereas, (The bank employee is committed to the ethics of professional information, within the limits of modifications) has the lowest acceptance level.

| S. No | Categories | Mean | S.D. |

|---|---|---|---|

| 1 | A bank employee is committed to ethics in professional information | 3.33 | 1.09 |

| 2 | The bank employee is obligated to provide professional information effectively | 3.72 | 1.13 |

| 3 | The bank employee evaluates the information objectively | 4.3 | 0.89 |

| 4 | The bank employee focuses on adhering to the ethics of professional information specified by the bank | 4.46 | 0.66 |

| 5 | Bank employees honestly share information ethics with each other | 3.43 | 1.15 |

| 6 | The bank employee shall abide by the ethics of professional information as is, without modification | 3.43 | 1.26 |

| 7 | A bank employee introduces the public interest over the personal interest | 4.16 | 0.81 |

| 8 | The bank employee is committed to the ethics of professional information, within the limits of modifications | 3.13 | 1.08 |

| 9 | A bank employee is obligated to confidentiality of information provided by clients | 3.24 | 1.15 |

| 10 | The bank employee adheres to the ethics of working with customers without bias | 3.38 | 1.09 |

| 11 | The bank employee exhibits humility in his dealings with his colleagues and customers | 4.12 | 0.9 |

| 12 | A bank employee is expected to constructively respect customer feedback | 4.35 | 0.71 |

| 13 | The bank employee is keen to set a good example for others | 3.82 | 1.08 |

| 14 | A bank employee avoids mentioning their colleagues' flaws to the outside community | 3.51 | 1.14 |

| 15 | The ethics charter in the bank receives great interest from the bank employee | 3.93 | 0.94 |

| 16 | A bank employee highlights the importance of information ethics and its connection to customers | 4 | 0.94 |

| 17 | A bank employee views the concept of teamwork as an ethical concept | 3.74 | 0.93 |

| 18 | The bank employee directs his colleagues for any unethical behavior | 3.75 | 0.92 |

| 19 | The bank employee adheres to the etiquette of talking and discussing with customers | 3.52 | 0.87 |

| 20 | The bank employee maintains ethical behavior with the opposite sex | 3.83 | 0.92 |

| 21 | The bank employee is keen to control his behavior and his emotions with customers | 3.4 | 0.89 |

| 22 | The bank employee provides the necessary information and services to customers with accuracy and transparency | 3.93 | 0.93 |

| 23 | The bank employee provides the service information for the first time with complete credibility and clarity | 4.22 | 1.01 |

| 24 | The bank employee provides the required service information on time without delay | 3.95 | 1.26 |

| 25 | A bank employee handles problems that occur during customer service, if they occur | 3.65 | 1.3 |

| 26 | The commitment of the bank employee to the ethics of professional information with regard to privacy contributes to the increase in the number of customers | 3.95 | 1.27 |

| 27 | The bank's adoption of professional information ethics contributes to achieving service and profits | 4.09 | 1.07 |

| 28 | Applying safety, trust, privacy and reliability policies with the ethics of professional information increases the number of clients and achieve the required profits and service | 3.78 | 0.75 |

| Grand Mean | 3.79 | 0.48 | |

Table 7: Ethics of Professional Information in the Work Environment to Achieve Service and Profits.

2. What is the assessment of the dimensions of professional information ethics as a (resource, goal, and product) for the bank?

Above Table 8 shows that the grand mean of the variable reflects high level of acceptance toward above variable. also, it was found that (The bank employee is obligated not to misuse the information as a resource, a goal, and a product) has the highest acceptance level, whereas, (The customer information and their data are dealt with by the employee related to the subject matter, considering this information as a resource, a goal, and a product) has the lowest acceptance level.

| S. No | Categories | Mean | S.D. |

|---|---|---|---|

| 1 | The bank employee shall comply with the regulations and instructions issued by the bank | 3.63 | 1.12 |

| 2 | The bank employee is keen to implement and implement the vision and mission of the bank | 3.9 | 0.99 |

| 3 | The bank employee participates in the activities and events of the bank | 4 | 0.83 |

| 4 | A bank employee keeps bank property | 3.55 | 1.19 |

| 5 | A bank employee keeps bank information secrets as a resource, target, and producer | 3.82 | 1.19 |

| 6 | The bank employee is obligated not to misuse the information as a resource, a goal, and a product | 4.16 | 0.78 |

| 7 | The customer information and their data are dealt with by the employee related to the subject matter, considering this information as a resource, a goal, and a product | 3.4 | 1.14 |

| 8 | A bank employee provides adequate protection for customer information as a resource, target, and producer | 3.78 | 0.9 |

| 9 | A bank employee is obligated not to share customer personal information with another bank as it is a supplier, target, and product of his bank only | 3.48 | 0.92 |

| 10 | A bank employee has the right to provide information as a supplier, target, and producer to his bank only about customer misconduct in transactions with another bank | 3.62 | 0.94 |

| 11 | The customer adheres to the ethics of the information obtained from the employee as a resource, goal, and product for both parties | 3.81 | 0.91 |

| 12 | Information Bank Officer provides accurate, error-free reporting to customer accounts as a supplier, target, and producer of both parties | 3.53 | 0.94 |

| 13 | A bank employee has the ability to prevent any intruder from accessing customer information and data | 3.67 | 0.95 |

| Grand mean | 3.72 | 0.66 |

Table 8: Dimensions of Professional Information Ethics as a (Resource, Goal, and Product) for the Bank

3. Are there statistically significant differences at the level of significance (α ≤ 0.05) in the extent to which bank employees adhere to the ethics of professional information in the work environment to achieve service and profits due to the variable of gender, education level, job, experience?

Tests of between-subjects effects

ANCOVA Test is used to answer above Question, It is found that:

Gender: F value is not significant at 0.05 levels, that means there are no statistically significant differences at the level of significance (α ≤ 0.05) in the extent to which bank employees adhere to the ethics of professional information in the work environment to achieve service and profits due to the variable of gender as shown in Table 9.

| Source | Type III Sum of Squares | df | Mean Square | F | Sig |

|---|---|---|---|---|---|

| Corrected Model | 13.944a | 4 | 3.486 | 17.741 | 0 |

| Intercept | 199.437 | 1 | 199.437 | 1015.03 | 0 |

| Gender | 0.025 | 1 | 0.025 | 0.129 | 0.72 |

| Education Level | 5.835 | 1 | 5.835 | 29.697 | 0 |

| Job | 0.643 | 1 | 0.643 | 3.273 | 0.071 |

| Experience | 0.286 | 1 | 0.286 | 1.457 | 0.228 |

| Error | 67.787 | 345 | 0.196 | - | - |

| Total | 5120 | 350 | - | - | - |

| Corrected Total | 81.731 | 349 | - | - | - |

Note: a : level of significance

Table 9: Dependent Variable: Commitment

Level of education: F value is significant at 0.05 levels, that means there are statistically significant differences at the level of significance (α ≤ 0.05) in the extent to which bank employees adhere to the ethics of professional information in the work environment to achieve service and profits due to the variable of gender due to Level of education. And these differences tend to increase in the (Bachelor) sample more than (Master) sample, as shown in the following in Table 10.

| Categories | Mean | N | S.D. |

|---|---|---|---|

| BA | 3.9374 | 226 | .52007 |

| Master | 3.5328 | 124 | .25129 |

| Total | 3.7941 | 350 | .48393 |

Table 10: Level of Education

JOB: F value is not significant at 0.05 levels, that means there are no statistically significant differences at the level of significance (α ≤ 0.05) in the extent to which bank employees adhere to the ethics of professional information in the work environment to achieve service and profits due to the variable of job.

Experience: F value is not significant at 0.05 levels, that means there are no statistically significant differences at the level of significance (α ≤ 0.05) in the extent to which bank employees adhere to the ethics of professional information in the work environment to achieve service and profits due to the variable of experience.

Results and Discussion

Since this study is the first of its kind in Jordan in terms of focusing on adhering to information ethics among bank employees, we can conclude that there is a perception by Jordanian bank employees about the importance of information ethics in its various dimensions and its impact on business performance. The results also showed that commitment to information ethics through employees in banks has a positive effect in increasing profits and developing services, which in turn is reflected in information ethics as a resource, goal and product for Jordanian banks (El-Helou, 2000). As a result of the compatibility and between all the study variables, this will increase the efficient performance of work and competitiveness at all local, regional and international levels, in addition to the effect of the variable privacy and reliability of customer information on increasing customers and providing advanced services, which will be reflected in the performance of work in general.

Conclusion

Through the analysis of the above data, the results indicate that the level of commitment to information ethics in Jordanian banks was high and enjoyed the highest level of acceptance in terms of adherence to the ethics specified by the bank with an average of (4.46) and standard deviation (0.66) to achieve service and profits in the work environment.

The reason here is that Jordanian banks are interested in developing their services from traditional to electronic in a large and expanded way to achieve the profits they seek and which are reflected on the customer and the employee at the same time. In addition, employees evaluate professional information highly objectively and evaluate customer feedback constructively. These results are in agreement with Helou study which indicated that Jordanian banks will not be able to work and compete with regional and international banks if they do not develop their business and information to keep pace with the electronic developments that have proven to increase the services and profits sought by the banks and also increase the number of customers.

With regard to the privacy and reliability of information related to the bank and customers, the study indicated the commitment of employees not to share information of any kind with other parties through the application of security, trust, privacy and reliability policies with ethics of professional information that leads to an increase in the number of customers and the achievement of profits and required services, as the arithmetic indicated (3.78) and standard deviation (0.75) which is reflected in providing high-level service and achieving high profits as well as in the interest of the bank by increasing confidence between the customer and the bank. This result is also consistent with a previous study on Jordanian banks for, which aimed to explain the problems facing information systems in Jordanian banks in light of the development of electronic services, and the results indicated that the establishment and development of information systems in banks will provide information privacy, reliability and safety for clients and to do business in addition to its agreement with the Interactive Study (2002) about knowing what customers want from the companies that deal with them over the Internet in relation to the privacy of information and how to preserve it from leakage. Customers have expressed their great concern about the mechanism of preserving the privacy of their information while dealing online.

In the second part of the study, the results of the evaluation of the dimensions of the bank's professional information ethics (as a resource, a goal, and a product) showed that the bank employee is obligated not to misuse the information, which is reflected in the performance of business in Jordanian banks, which was high with a mean average of (4.16) and standard deviation(0.78) reinforces this conclusion keenness of staff to implement and apply the vision and mission of the bank and participate in all activities and events of the Bank. That is, they work as a team to develop services and increase profits. It all depends on their commitment to professional information ethics as the resource, goal and product through which they can achieve the vision and mission of the bank as Jordanian banks tended after the Corona pandemic to adhere to information ethics more and more to keep pace with developments in electronic business and increase their competitiveness, which increased their services and profits, and it can be said that they are the only institutions that have not been affected by this pandemic by performing their business remotely. These results are in agreement with study which indicated that the information and technologies provided by it in the general environment of Syrian banks have a positive impact on increasing productivity, performance of work, improving it effectively and achieving its goals.

The results of the study also indicated the existence of a statistically significant impact on the provision of service as one of the dimensions of commitment to ethics of professional information in achieving profitability for Jordanian banks at the significance level (α ≤ 0.05) as well as the existence of a statistically significant effect of the privacy variable as one of the dimensions of professional information ethics and its positive reflection on the service and profitability of banks. The results also indicated a statistically significant effect of ethics of professional information as a resource, goal and product for Jordanian banks on work performance at the significance level (α ≤ 0.05). These results are in agreement with the Tarawneh (2013) study which aimed to demonstrate the impact of electronic business ethics on business performance and achieving competitiveness, and the presence of a statistically significant effect of business ethics on achieving profits and providing services efficiently. Major findings of the study:

The proposition of LIS teachers working in universities across 7 UGC regional offices is relatively higher in northern regional office with 73 (25.44%), followed by south-western regional office with 59 (20.56%) and lease is central regional office with 17 (5.92%).

The average number of awarded and ongoing Ph.D. in universities under south eastern regional office is relatively higher than universities under other regional offices of UGC followed by south-western regional office. The mean value of south eastern regional office in completed and ongoing Ph.D. degree is 10.69 followed by 9.59 is south-western regional office.

The average number of awarded and ongoing degrees of master of philosophy in universities under south eastern regional office is relatively higher than universities under other regional offices of UGC followed by western regional office.

The mean value of south eastern regional office in completed and ongoing M.Phil. degree is 24.03 Followed by 8.38 is western regional office.

Recommendations

Based on the results and conclusions of the study, the following recommendations can be included to increase the interest in information ethics and their impact on work performance in Jordanian banks: Increased interest by bank departments in information ethics, which will have a positive effect in the long term on business performance that increases profit and services development.

Work on developing and training employees on the adherence to information ethics and its multiple dimensions, whether for clients or banks, through periodic monthly workshops in a sustainable manner.

Creating an atmosphere of trust between the employee and the work environment in banks by providing material and moral incentives in terms of adherence to information ethics.

Conducting more studies related to information ethics and its impact on business performance and its application to other commercial enterprises in Jordan.

References

- Al-Ali, A, and Qassem, A. "The effect of information technology in developing the systems of operations of public banks in Syria." Damascus University Journal of Economic and Legal Sciences 28.1(2012): 23-40.

- Alqashi, Z. "The Effectiveness of Accounting Information Systems in Achieving Security, Assurance and Reliability in Light of Electronic Commerce, Master Thesis." Amman Arab University for Graduate Studies, Jordan (2003).

- Al-Tarawneh, A. "The Impact of Business Ethics and Social Responsibility in Achieving Competitive Advantage, the Second International Conference on Administrative and Economic Opportunities in the Organizational Business Environment." Mu'tah University: College of Business Administration, Jordan (2013): 23-25.

- Amadeo, K. Profit, the Catalyst for Capitalism: Two Foolproof Ways to Increase Profit. The Balance. What-is-profit-and-how-does-it-work-3305878.

- Bourgeois, David. "Information systems for business and beyond." The Saylor Foundation (2014).

- Conroy, K. "Why You Need Good Business Ethics." Michigan: Edward Lowe Foundation. (2021).

- Hindawi. Foundation Information Ethics.

- Horton, M. "Are Business Ethics Important for Profitability? " New York Dotdash. how-important-are-business-ethics-running-profitable-business.asp (2021).

- Investopedia. What Is the Service Sector? (2021).

- Jaseviciene, Filomena. "The ethics of banking: Analysis and estimates." Ekonomika 91 (2012): 101-116.

- Kour, Manjit. "Significance of Ethics in Banks." International Journal of Management and Social Sciences Research 6.12 (2017): 6-9.

- Kuvaas, Bard. "Performance appraisal satisfaction and employee outcomes: Mediating and moderating roles of work motivation." The International Journal of Human Resource Management 17.3 (2006): 504-522.

- Martin, Kirsten, Katie Shilton, and Jeffery Smith. "Business and the ethical implications of technology: Introduction to the symposium." Journal of Business Ethics 160.2 (2019): 307-317.

- Damilola, Omodara, et al. "Global pandemic and business performance: Impacts and responses." International Journal of Research in Business and Social Science 9.6 (2020): 01-11.

- David, B, and J. D. Resnik. "What is ethics in research & why is it important." National Institute of Environmental Health Science (2011).

- Rietdijk, Tames. "How to Improve Ethics in Banks and Financial Institutions." Netherlands: Business Forensics. (2020).

- El-Helou. "The effect of using information systems and technology on integrated banking services in Jordanian banks from the perspective of banking leaders." Master Thesis, (2000). Al al-Bayt University, Jordan.

- UNESCO. Information Ethics.

- Washington State University. 3 Reasons an Ethical Business Leads to Profits. Washington: Washington State University (2020).

- Zwick, T. "The impact of training intensity on establishment productivity." Industrial Relations: A Journal of Economy and Society 45.1 (2006): 26-46.

Author Info

Othman Abdulkader Obeidat1*, Nidal-Al-Ahmad2*, Mohammad Khaled Issa Al Shboul1* and Siham Ahmad3*2Department of the National Library Management, Haroun Al Rasheed St9, Al-Balqa Applied University, Amman-500001, Jordan

3Department of Library and Information Management, Al-Balqa Applied University, Al-Salt College for Human Sciences, Salt-19110, Jordan

Received: 23-May-2022, Manuscript No. IJLIS-22-32099; Editor assigned: 26-May-2022, Pre QC No. IJLIS-22-32099 (PQ); Reviewed: 09-Jun-2022, QC No. IJLIS-22-32099; Revised: 20-Jun-2022, Manuscript No. IJLIS-22-32099 (R); Published: 27-Jun-2022, DOI: 10.35248/2231-4911.22.12.829

Copyright: This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Call for Papers

Authors can contribute papers on

What is Your ORCID

Register for the persistent digital identifier that distinguishes you from every other researcher.

Social Bookmarking

Know Your Citation Style

American Psychological Association (APA)

Modern Language Association (MLA)

American Anthropological Association (AAA)

Society for American Archaeology

American Antiquity Citation Style

American Medical Association (AMA)

American Political Science Association(APSA)